In the ever-evolving landscape of technology investments, Fintechzoom IBM Stock remains a focal point for investors seeking stability and growth. As of 2024, IBM has demonstrated resilience through strategic shifts towards artificial intelligence and cloud computing.

However, recent financial reports indicate mixed results, with strong software growth offset by challenges in consulting and infrastructure segments.

This analysis delves into IBM’s current market performance, evaluates key financial indicators, and examines expert opinions to determine whether now is the opportune moment to buy or sell IBM stock.

Fintechzoom IBM Stock Market Overview

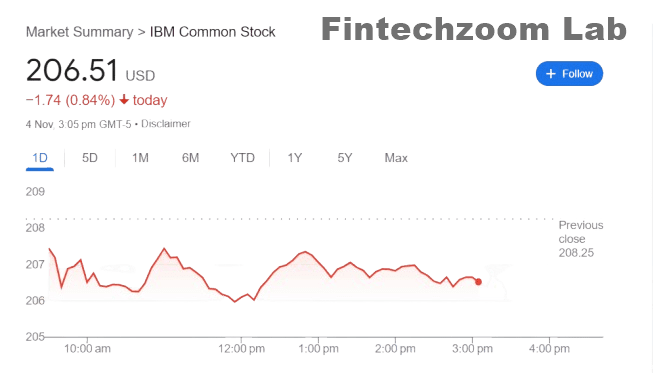

IBM’s history is rich with technological breakthroughs, yet its stock performance over the last decade has been somewhat inconsistent. In recent years, Fintechzoom IBM Stock price has been characterized by a pattern of steady gains followed by periods of stagnation. These fluctuations are driven by both internal factors like corporate restructuring and acquisitions and external pressures from market competitors and economic shifts.

In 2024, IBM’s stock performance demonstrated moderate growth, attributed to strategic moves such as partnerships and its push into advanced tech sectors. However, the tech landscape’s competitive nature and the lingering impacts of global economic downturns influenced periods where Fintechzoom IBM stock value faced headwinds. For potential investors, understanding the nuances behind these shifts is critical.

Key Factors Influencing Fintechzoom IBM Stock Price

Several pivotal factors will shape Fintechzoom IBM Stock price as we move through 2024:

1. Technological Advancements and R&D Investments

IBM’s investment in research and development, particularly in quantum computing and artificial intelligence, is a significant factor that could drive long-term growth. By focusing on cutting-edge technology, IBM seeks to carve a niche in a market dominated by titans like Microsoft and Google. IBM’s quantum computing breakthroughs aim to revolutionize industries and offer competitive advantages that may strengthen its market position.

2. Economic Environment

Macroeconomic variables such as inflation, interest rate changes, and global supply chain disruptions can impact Fintechzoom IBM Stock. For example, if inflation continues to rise, corporate spending may shrink, which could affect IBM’s revenue streams. Additionally, geopolitical tensions and their implications on international trade policies are other key elements investors need to monitor.

3. Strategic Acquisitions and Partnerships

IBM’s history of acquisitions, including Red Hat, reflects its focus on bolstering cloud capabilities. These partnerships have helped fortify its cloud computing strategy, making IBM stock an attractive option for investors looking at long-term growth. However, the success of these strategies heavily depends on the seamless integration of acquired technologies and services.

4. Competition in the Tech Sector

Competing against powerhouses like Amazon and Microsoft, IBM’s position in the cloud market and AI sector remains under constant pressure. These competitors have larger user bases and higher brand visibility, challenging IBM to distinguish itself through unique offerings and robust service delivery. To maintain and grow its stock value, IBM must ensure it provides unparalleled solutions that clients see as essential.

Technological Advancements: The Driving Force for IBM Stock Growth

A significant portion of IBM’s value proposition lies in its commitment to innovation. IBM’s advancements in quantum computing, for example, hold immense potential for industries that require massive computational power, such as pharmaceuticals, aerospace, and financial services. The promise of quantum technology lies in its ability to solve complex problems that are currently beyond the capabilities of classical computing.

The company has also made strategic moves to strengthen its presence in the artificial intelligence and data analytics space. By expanding its AI capabilities, IBM aims to remain competitive and meet the growing demand for intelligent automation across various sectors. If these initiatives translate into practical applications that industries can adopt, the ripple effect on Fintechzoom IBM stock growth could be significant.

Challenges Impacting IBM’s Financial Performance

Despite the positive outlook tied to technological investments, IBM faces several hurdles. One of the major challenges impacting IBM’s financial performance is its reliance on legacy business units. Although IBM has made strides in modernizing these operations, the slow pace has affected profit margins. This aspect poses a concern for both current and prospective investors who are evaluating IBM’s long-term growth prospects.

Additionally, the tech industry’s fast-paced evolution is a double-edged sword. While it presents opportunities, it also demands continual adaptation and substantial investment. Failing to keep up with emerging trends could erode IBM’s market share and stock performance.

Another pressing issue is the labor market. Talent acquisition and retention in the tech field are becoming increasingly competitive, with many skilled professionals gravitating toward companies that have more modern and flexible work environments. For IBM to remain a leading player, it must address this challenge by evolving its corporate culture and offering appealing work incentives.

Financial Indicators: What They Reveal About IBM’s Future Potential

A thorough examination of IBM’s financial reports can provide insight into its future trajectory. For example, the company’s quarterly earnings reports have shown a consistent, albeit slow, growth trend. This stability is attractive to conservative investors who prioritize secure, long-term investments over rapid, volatile gains.

In particular, the following metrics are essential to watch:

Revenue Growth

The steady increase in revenue from IBM’s hybrid cloud and AI services is a positive sign. However, this must continue at an accelerated pace to justify further stock appreciation.

Profit Margins

IBM’s efforts to enhance its profit margins have met with mixed success. While the growth of high-margin services like software and cloud solutions is a step in the right direction, the company’s overall margins remain under pressure due to the drag from legacy businesses.

Earnings Per Share (EPS)

Investors often look at EPS to assess profitability. IBM’s consistent EPS can indicate stable cash flow, but a significant increase would make IBM stock even more attractive.

Expert Opinions on IBM Stock

Opinions from financial analysts provide valuable context for any investment decision. Luxury FintechZoom and other expert platforms often highlight IBM’s dual nature: a legacy tech giant in the midst of significant transformation. While some analysts are optimistic, citing IBM’s move into future-proof sectors, others express caution due to its slower growth compared to more aggressive tech players.

Analysts suggest that Fintechzoom IBM Stock could be a strong addition to a diversified portfolio, particularly for those looking to balance risk. The stock’s dividend history further supports this claim, making it appealing for income-focused investors. However, experts also stress the importance of monitoring market conditions and IBM’s financial reports for signs of accelerated growth or stagnation.

Comparison with Competitors: IBM vs. Other Tech Giants

To fully appreciate IBM’s position, a comparative analysis with its peers is crucial. Companies such as Microsoft and Google have outpaced IBM stock in terms of growth due to their broader range of offerings and quicker adaptation to market trends. However, IBM’s unique selling points such as its focus on quantum computing and hybrid cloud solutions offer a different kind of value proposition.

For instance, while Microsoft’s Azure has gained a massive following, IBM’s hybrid cloud approach offers flexibility that appeals to enterprises with complex IT infrastructures. This focus could enable IBM to carve out a niche that supports incremental growth in IBM stock value over time.

Is Now the Right Time to Buy or Sell IBM Stock?

Investors face a key decision: Is now the moment to invest in IBM stock, hold existing shares, or exit the position? The answer largely depends on an individual’s investment strategy and risk tolerance.

For long-term investors, IBM’s strong dividend history and commitment to innovation may outweigh short-term concerns. The company’s push toward next-gen technologies such as quantum computing and AI presents significant upside potential. Yet, those seeking short-term gains may find Fintechzoom IBM Stock less appealing due to its gradual pace of growth and existing challenges.

Ultimately, timing the market is complex. Investors should assess IBM’s recent quarterly earnings, track financial trends, and stay updated on external economic conditions to make well-informed decisions.

Conclusion

Fintechzoom IBM Stock remains a compelling but nuanced choice in the investment landscape. The company’s historical significance and recent forays into transformative technologies make it a viable option for those seeking stable, long-term growth. However, potential investors must weigh these positives against the persistent challenges tied to legacy operations and competition.

Strategically, IBM’s investments in cloud and quantum computing may pay off in substantial gains over the coming years, but patience will be required. Monitoring financial reports, market conditions, and expert opinions can provide the insights needed to decide whether to buy, hold, or sell Fintechzoom IBM Stock in 2024.

FAQs About IBM stock

What are the main factors influencing IBM stock in 2024?

Key influences include technological innovations, global economic trends, and IBM’s quarterly earnings.

How does IBM’s hybrid cloud strategy compare to its competitors?

IBM’s hybrid cloud strategy offers unique flexibility, setting it apart from pure cloud providers like Microsoft Azure, which can influence IBM’s market position.

Is it risky to invest in IBM stock now?

While risks are present, particularly due to legacy business challenges, IBM’s push into AI and quantum computing could balance out long-term returns.

What financial metrics should be monitored for IBM stock?

Important metrics include EPS, revenue growth, and profit margins to gauge IBM’s profitability and growth trajectory.

Can IBM’s investments in emerging technology boost its stock?

Yes, IBM’s investments in quantum computing and AI hold the potential to drive future growth and impact IBM stock value positively.

How do economic conditions affect IBM stock?

Factors like inflation and geopolitical instability can affect IBM’s revenue streams and overall stock performance.

What is the outlook for IBM stock in the next 5 years?

If IBM successfully capitalizes on its technological investments and addresses its legacy issues, IBM stock could experience steady, long-term growth.