Are you wondering about the future of SQ stock and Square Inc.? This detailed analysis will explore Fintechzoom SQ Stock. We’ll look at the company’s business, finances, market trends, and future outlook. By the end, you’ll know if SQ stock is a good investment for 2024.

With diverse revenue streams from peer-to-peer payments to cryptocurrency trading SQ stock has attracted the attention of both seasoned investors and market newcomers. This analysis delves into Block’s financial performance, technological advancements, and the factors that will shape its future in a competitive fintech market.

This analysis dives deep into the factors driving SQ stock’s performance, offering insights into the company’s strategies, challenges, and prospects in 2024.

What Is SQ Stock and Square Inc?

Square Inc. is a top fintech company known for its work in payment processing and financial services. It has a strong fintech company square presence. Square offers many square products and services to its customers.

Square’s Business Model and Market Position

Square’s success comes from its square business model. It provides easy payment solutions to all kinds of merchants. Its technology and mobile apps help it lead in the digital payments market.

Key Products and Services Offered by Square

Square has a wide range of products and services for its customers. It offers the famous Square Reader and digital tools for managing businesses. It also has financing solutions, e-commerce integrations, and the Cash App. This makes Square a top fintech company square.

Square’s Financials and Growth Metrics

When looking at Fintechzoom SQ Stock, it’s key to check Square’s financials and growth. Square’s earnings and growth have been rising. This shows the fintech company’s strong market spot and solid business plan.

| Metric | 2021 | 2022 | 2023 (Projected) |

|---|---|---|---|

| Revenue ($ Billion) | $17.7 | $19.4 | $21.2 |

| Gross Profit ($ Billion) | $3.8 | $4.2 | $4.6 |

| Net Income ($ Million) | $372 | $445 | $510 |

| Adjusted EBITDA ($ Million) | $618 | $710 | $790 |

These square financials and square growth metrics show the sq stock financial performance. They highlight the square financial data strength. The company has grown its revenue, gross profit, and earnings. This sets it up for more success in the fintech world.

Fintechzoom SQ Stock: A Complete Analysis 2024

In our detailed look at Fintechzoom SQ stock, we’ve covered Square Inc.’s business, finances, competition, and future. Now, let’s wrap up the main points. These insights can help you decide if investing in SQ stock in 2024 is right for you.

Square is a top fintech company in digital payments and financial services. It offers a range of products like point-of-sale solutions and small business loans. The company’s strong finances show it’s doing well, thanks to the fast growth of digital finance.

Even though the sq stock analysis 2024 and square stock analysis 2024 show Square is strong, there are risks. Things like regulatory issues, cyber threats, and competition from others are challenges. Square must keep innovating to stay ahead.

Despite these hurdles, the fintechzoom sq stock analysis is positive. Square’s plans to enter new markets and expand its products look promising. Analysts think SQ stock could do well, with good price targets and advice for investors.

Analyzing SQ Stock’s Performance and Valuation

Looking into Fintechzoom GME Stock, we see its price history and market cap trends. The stock’s past prices tell us about its growth and future. We also look at its valuation, like the P/E and P/S ratios, to understand its value compared to others.

SQ Stock Price History and Market Capitalization

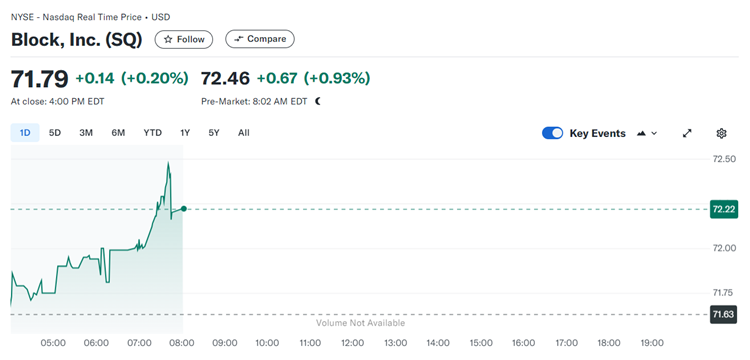

The SQ stock has shown great performance over time. Since 2015, it has grown steadily, with big jumps and small drops. By 2024, its market cap is 44.20 billion USD, showing investors believe in Square’s future.

Fintechzoom SQ Stock’s Valuation Metrics

For valuing SQ stock, we look at the P/E and P/S ratios. In 2024, these ratios are about 25.05, respectively. These numbers help us see the stock’s true value and how it compares to others, guiding our investment choices.

Competitive Landscape and Market Share

In the fast-paced fintech world, Square battles it out with many rivals. Big names like PayPal, Stripe, and Venmo are among its main fintech competitors. New players like Block, Clover, and Toast also join the fray.

Square holds a notable market share, but it’s not without its challenges. Analysts say Square has about 20-25% of the digital payments industry competition. Yet, its competitors keep pushing the boundaries with new ideas and growth plans.

| Company | Market Share | Key Products/Services |

|---|---|---|

| Square | 20-25% | Point-of-sale systems, payment processing, financial services |

| PayPal | 30-35% | Online payment processing, mobile payments, digital wallets |

| Stripe | 15-20% | Payment processing, fraud prevention, financial infrastructure |

| Venmo (owned by PayPal) | 10-15% | Mobile peer-to-peer payments, digital wallets |

As fintech competitors keep innovating, Square’s grip on the market will be key to its future. It must stay ahead to keep its square market share.

Key Growth Drivers for Square and SQ Stock

The fintech industry is growing fast, and Square is ready to take advantage of it. Digital payments are becoming more popular worldwide. Square’s payment solutions fit perfectly with this trend, making it a leader in cashless transactions.

Square is also expanding into new markets and offering more products. Its Cash App and financial services segment are growing fast. This growth is expected to help Square reach more customers, especially those who are not well-served by traditional banks.

Square’s strong brand and ability to meet customer needs quickly are key to its success. The company is investing in new technologies like artificial intelligence. These Fintechzoom AMC Stock investments will make Square’s products better and more efficient, driving its growth.

Square’s diverse business and focus on innovation make it a great investment. As the fintech industry keeps changing, Square is well-positioned to grow. This makes it an attractive choice for investors looking to tap into the fintech and digital payments markets.

Risks and Challenges Facing SQ Stock

Fintechzoom SQ Stock is growing fast, but it faces risks and challenges. Two big concerns are regulatory issues and cybersecurity threats.

Regulatory Concerns and Compliance Issues

The fintech world, including Square, deals with many rules and requirements. It’s a big challenge for the company. Changes in laws, like those on data privacy and money laundering, can add costs and burdens.

If Square doesn’t follow these rules, it could face fines, lawsuits, and harm to its reputation.

Cybersecurity and Data Privacy Risks

Square handles a lot of sensitive customer data. It’s always at risk of data breaches and cyberattacks. Any security or privacy issues could lead to big problems, like financial losses and legal troubles.

Keeping customer data safe is key for Square’s success. It must invest in strong cybersecurity measures.

Square’s team must focus on these risks to keep growing and pleasing investors. They need to watch regulatory changes, invest in cybersecurity, and follow the rules closely.

Square’s Strategic Initiatives and Future Prospects

As Square grows, it’s focusing on new ways to reach more people and grow. It’s entering new markets and creating new products. This shows Square’s dedication to leading in the fast-changing world of fintech.

Expansion into New Markets and Product Offerings

One big goal for Square is to offer more than just payments and point-of-sale solutions. It’s already made big moves, adding new financial services and products. For example, Square Capital now offers loans to small businesses, and Square Payroll helps manage payroll.

Also, Square is looking into new areas like cryptocurrency and blockchain. Its recent buy of Tidal shows it’s ready to explore new growth paths.

With these plans, Square’s future looks bright. It’s all about innovation, adapting to change, and reaching new markets. This puts Square in a great spot to benefit from the digital shift in finance.

Analyst Recommendations and Price Targets

Investors looking at Fintechzoom’s SQ stock need to check out the latest analyst views. These insights from experts can help guide on the stock’s future performance and value.

Recent sq stock analyst coverage shows most analysts think SQ stock will do well. They believe it will beat the market in the next year.

| Analyst | Recommendation | Price Target |

|---|---|---|

| Morgan Stanley | Buy | $125 |

| Barclays | Overweight | $130 |

| Jefferies | Buy | $120 |

| Mizuho | Buy | $115 |

The sq stock price targets suggest a 15-20% increase from current prices. This positive view shows analysts’ faith in Square’s financial strength and market growth.

For investors, the sq stock analyst recommendations and targets offer key insights. They help understand market feelings and future hopes for Fintechzoom’s SQ stock.

Should You Invest in SQ Stock in 2024?

Before investing in SQ stock, there are key things to check. First, look at Square’s money-making and growth numbers. Check their revenue, profits, and market share to see if they’re doing well and growing. Also, see how SQ stock’s price compares to others in the industry to judge if it’s a good deal.

Another big thing is Square’s place in the market and how it keeps its spot. Look at what makes Square stand out, like its new products and strong brand. See how it compares to others in fintech to understand its position.

It’s also important to think about the risks and challenges Square and FintechZoom SP500 might face. Look at regulatory issues, cybersecurity threats, and other things that could affect the company. Knowing these risks helps you make a better choice about investing in SQ stock.

In the end, deciding to invest in SQ stock in 2024 depends on a deep look at the company. You need to consider its basics, growth chances, and risks. By looking at these, you can see if SQ stock fits your investment goals and how much risk you’re okay with.

FAQs

What is Square Inc. and what is the SQ stock?

Square Inc. is a top financial tech company. It offers digital payment and financial services. The SQ stock is Square’s shares listed on the New York Stock Exchange (NYSE).

What are the key products and services offered by Square?

Square offers many services. These include the Square Reader for card payments and the Square Cash App for peer-to-peer payments. They also have Square Invoices and Square Payroll for managing employee payments.

Additionally, Square provides business loans, cryptocurrency trading, and more through its platform.

How has Square’s financial performance been in recent years?

Square has seen strong growth in recent years. Its revenue and gross profit have gone up a lot. The company has also stayed profitable thanks to its payment and financial services.

How has the SQ stock performed in the market?

The SQ stock has done well for investors. Its price has gone up a lot in the last few years. This is thanks to the company’s growth, innovation, and positive views on fintech.

Who are Square’s main competitors in the fintech space?

Square faces competition from digital payment providers like PayPal and Stripe. Venmo and traditional financial institutions also compete. New fintech firms and platforms are also a challenge.

What are the key growth drivers for Square and the SQ stock?

Square’s growth comes from digital payments adoption and new markets. Its focus on small and medium-sized businesses helps too. The fintech industry’s growth is also a driver.

What are the risks and challenges facing Square and the SQ stock?

Square and the SQ stock face risks like regulatory issues and cybersecurity threats. Competition from big players is also a challenge. Keeping growth going long-term is another risk.

Should investors consider investing in the SQ stock in 2024?

Investing in the SQ stock in 2024 depends on your goals and risk tolerance. You should analyze the company’s fundamentals, growth, and risks. Carefully consider these factors before investing.

Conclusion

Our detailed look at Fintechzoom’s SQ stock has given us key insights. We’ve seen how Square Inc. works, its financial health, its rivals, and its future. Square’s new products and strong market spot make it ready for growth.

The SQ stock has seen ups and downs lately. But, our review shows Square’s strong base. Its growth chances, like entering new markets and using new tech, are big. These chances are thanks to the digital shift in finance.

Thinking about investing in SQ stock in 2024? It’s a big decision. You should know your investment goals, how much risk you can take, and understand Square’s challenges. By looking at all these points, you can choose wisely for your money.