In the rapidly evolving world of technology, Advanced Micro Devices (AMD) stands out as a key player in the semiconductor industry. Known for its innovative products and intense competition with industry giants like Intel and Nvidia, AMD has continuously pushed the boundaries of computing power and performance. Naturally, AMD Stock Fintechzoom attracts significant attention from investors looking for growth in the tech sector.

This comprehensive guide delves into the latest updates on AMD stock predictions provided by Fintechzoom, examining key factors that impact its trajectory, and analyzing expert insights to provide a comprehensive view of its investment potential.

Current Market Landscape for AMD

The technology sector is undergoing a transformative phase, and AMD has found itself at the forefront of these changes. From cloud computing to gaming and artificial intelligence (AI), AMD products are critical to many of these emerging fields.

In recent years, AMD has captured market share from competitors and grown its influence in the tech industry. Fintechzoom AMD stock reports highlight the company’s expanding footprint, especially as demand for high-performance computing rises globally.

The global demand for semiconductors has surged in recent years, fueled by developments in AI, data centers, gaming, and autonomous driving. As a significant player, AMD has benefitted from this rising demand.

Fintechzoom AMD stock updates frequently note the impact of supply chain fluctuations and international trade policies, especially as the semiconductor industry faces a critical shortage.

Historical Performance and Milestones

Evaluating AMD’s past performance is crucial in understanding the current stock predictions on Fintechzoom. AMD has a rich history, punctuated by significant milestones that reflect its innovation and resilience in a competitive industry.

The company first gained major attention in the early 2000s with its 64-bit processors, but it wasn’t until the mid-2010s, with the introduction of Ryzen CPUs and Radeon GPUs, that AMD became a formidable challenger to Intel and Nvidia.

In recent years, AMD has achieved substantial gains in market share, largely attributed to its Ryzen CPUs, which offered exceptional performance for a competitive price. This growth has led analysts to have high expectations, with Fintechzoom AMD stock predictions often citing these technological advances as a reason for optimism.

Furthermore, AMD’s acquisition of Xilinx, a leader in adaptive and intelligent computing, is another critical milestone, anticipated to expand AMD’s market presence in diverse fields such as 5G and automotive applications.

Recent Financial Highlights and Earnings Report

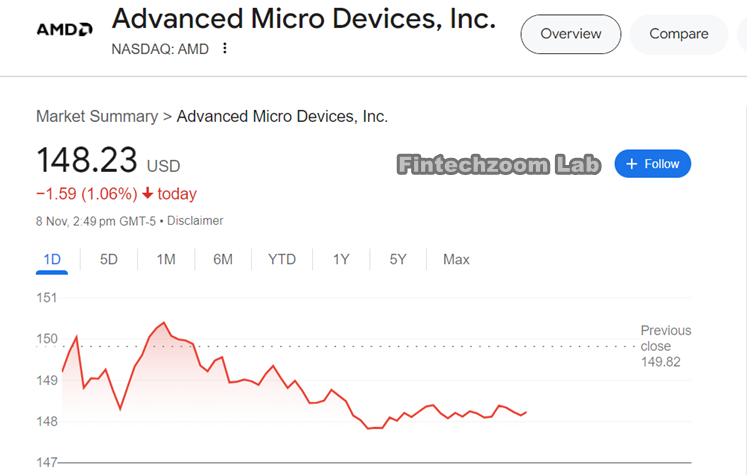

AMD’s earnings reports are closely monitored by analysts and investors alike. The company’s quarterly and annual financials are pivotal in shaping AMD stock predictions on Fintechzoom, as they reveal key performance indicators such as revenue, net income, and earnings per share (EPS). AMD’s most recent earnings report showed impressive revenue growth, attributed largely to demand for Ryzen processors and Radeon graphics cards. Additionally, the enterprise segment, which includes data centers, has emerged as a strong growth area.

Investors particularly watch the revenue growth rate because it provides insight into AMD’s competitive position and market expansion. In a recent quarter, AMD reported a significant year-over-year increase in revenue, driven by sales across its computing and graphics segments. These financial gains are a good indicator of AMD’s future performance.

However, some experts remain cautious due to potential supply chain constraints. The Fintechzoom AMD stock forecast reflects both the optimistic revenue potential and the caution surrounding supply chain issues.

Factors Affecting AMD Stock Fintechzoom Price

Several factors influence AMD stock predictions and drive its volatility. Among the most important is the company’s capacity for product innovation. AMD’s recent product lines, particularly its Ryzen and EPYC processors, are known for their performance and energy efficiency, making them popular choices in both consumer and enterprise markets. This innovative edge has helped AMD capture market share and maintain a competitive stance against rivals.

Another factor affecting AMD’s stock is the stability of the global semiconductor supply chain. The COVID-19 pandemic brought unprecedented disruptions to the global supply of semiconductor materials, impacting AMD’s manufacturing and distribution. Although the company has adapted, the global chip shortage remains a risk factor.

Moreover, government regulations on semiconductor exports also have implications for AMD’s sales, especially in international markets. Investors watching AMD stock price on Fintechzoom often weigh these factors before making investment decisions.

Expert Opinions on AMD Stock Fintechzoom Future

Numerous financial analysts and market experts provide predictions for AMD stock based on various metrics. While some experts are bullish on AMD due to its technological advancements and expanding market share, others recommend a cautious approach due to the volatility and uncertainties within the semiconductor industry.

Analysts on Find Luxury FintechZoom often provide AMD stock forecasts based on the latest financial data and competitive landscape, giving investors a spectrum of insights to consider.

Some experts believe AMD has substantial room for growth, especially in high-demand areas like data centers and AI processing. These analysts argue that AMD’s strategic partnerships and acquisition of Xilinx position it well for sustained growth.

However, other analysts caution that the company’s high valuation might not be sustainable, particularly if global supply constraints worsen. For a balanced view, Fintechzoom’s AMD stock insights compile various expert opinions, enabling investors to make informed decisions.

Potential Risks and Market Volatility

Investing in AMD stock comes with inherent risks, given the nature of the technology sector and the volatility of semiconductor stocks. Economic conditions, global trade policies, and semiconductor shortages are key factors that could impact AMD’s growth trajectory. Furthermore, any major product delays or technological advancements by competitors could also affect AMD’s market position.

With global economic uncertainties, some analysts have issued conservative AMD stock predictions. Fintechzoom AMD stock alerts regularly update investors on potential risks, helping them make timely decisions. By staying informed, investors can manage these risks more effectively, especially when market volatility is high.

Predictions for AMD Stock Fintechzoom Price in the Short and Long Term

For those interested in short-term trading, Fintechzoom’s predictions for AMD stock often focus on quarterly sales, earnings forecasts, and market sentiment. These short-term indicators are influenced by product launches, industry news, and quarterly financial reports. In the long term, however, AMD’s stock price will likely be shaped by its expansion into new markets, its ability to innovate, and its ongoing rivalry with Intel and Nvidia.

Some short-term forecasts predict fluctuations in AMD stock price due to expected supply chain challenges. However, long-term predictions are more optimistic, as AMD’s product roadmap suggests it will continue to play a significant role in high-growth industries like AI and machine learning. Fintechzoom’s AMD stock forecast provides a comprehensive view of these varying time horizons, helping investors align their strategies accordingly.

Competitive Analysis: AMD vs. Other Semiconductor Giants

AMD’s journey in the semiconductor market has always been marked by intense competition, particularly with Intel in the CPU market and Nvidia in the GPU space. The rivalry with these giants has spurred AMD to continuously innovate, keeping it relevant and competitive. Fintechzoom AMD stock predictions often account for these competitive dynamics, as AMD’s performance is directly impacted by the success and failures of its rivals.

In recent years, AMD has managed to close the gap with Intel, particularly in the consumer and data center markets. Meanwhile, Nvidia remains a formidable competitor in the GPU sector, particularly in high-performance and AI-focused graphics cards. Investors following AMD stock price on Fintechzoom are keenly aware of these rivalries, which can lead to both growth opportunities and potential risks for AMD.

Technological Innovations Driving AMD’s Growth

AMD’s emphasis on innovation is central to its competitive strategy. The company has made strides in high-performance computing with technologies like ray tracing and AI integration in its GPUs, capturing the interest of gaming enthusiasts and AI developers. Furthermore, AMD’s EPYC processors have gained traction in data centers, providing the power and efficiency needed for large-scale computing tasks.

These technological advances drive AMD’s appeal in various markets, contributing to Fintechzoom’s AMD stock value predictions. By delivering cutting-edge solutions across a range of applications, AMD has established itself as a technology leader. For investors, keeping an eye on AMD’s product roadmap and upcoming technology announcements can provide valuable insights into the company’s growth potential.

Role of Global Economic Factors

The broader economic environment has a direct influence on AMD’s stock price, with factors such as inflation, interest rates, and global trade policies affecting investor sentiment. In particular, inflationary pressures can impact manufacturing costs, while international trade policies can affect AMD’s supply chain and market access. The ongoing semiconductor shortage further complicates these dynamics, adding a layer of uncertainty to AMD’s financial outlook.

Investors following Fintechzoom AMD stock news are advised to stay informed on these macroeconomic factors, as they can lead to price volatility. By understanding the larger economic context, investors can better anticipate shifts in AMD’s stock price and adapt their strategies accordingly.

AMD’s Sustainability Initiatives and ESG Rating

Environmental, Social, and Governance (ESG) criteria are becoming increasingly important in the investment world. AMD has made substantial commitments to sustainability, including energy-efficient product designs and environmentally responsible manufacturing practices. These efforts contribute to AMD’s appeal among eco-conscious investors, with Fintechzoom AMD stock predictions frequently highlighting the company’s ESG initiatives.

As climate concerns grow, AMD’s commitment to sustainable practices not only aligns with global trends but also enhances its reputation. For investors who prioritize ESG factors, AMD’s initiatives represent a positive indicator of long-term viability, contributing to a favorable outlook in Fintechzoom’s AMD stock analysis.

Tips for Investors: Is AMD a Good Buy?

When it comes to investing in AMD, understanding the company’s strengths, challenges, and potential for growth is crucial. Investors are advised to consider both short-term and long-term perspectives, balancing the opportunities presented by AMD’s technological advancements against the risks posed by market volatility and competition.

Fintechzoom AMD stock advice highlights the importance of these considerations, offering insights that can guide investment decisions.

For those with a higher risk tolerance, AMD’s stock presents a compelling case for potential gains, given its innovative product lineup and expanding market reach. On the other hand, more conservative investors may prefer to monitor Fintechzoom AMD stock predictions for stability before making a commitment. By staying informed, investors can make well-rounded decisions that align with their financial goals.

Frequently Asked Questions (FAQs)

What is the current outlook for AMD stock according to Fintechzoom?

Fintechzoom provides a positive outlook for AMD stock, highlighting the company’s strong growth potential in areas like gaming, AI, and data centers. However, experts also point out that global supply chain challenges and competition from Intel and Nvidia could impact its trajectory.

How has AMD’s recent financial performance impacted its stock predictions?

AMD’s recent financial reports show strong revenue growth, especially in segments like data centers and consumer computing. This positive performance has led to optimistic predictions, as reflected in Fintechzoom’s AMD stock analysis, though supply chain issues remain a potential risk.

What are the main factors influencing AMD Stock Fintechzoom price?

Key factors impacting AMD’s stock price include product innovation, market share gains, global semiconductor supply issues, and competition from companies like Intel and Nvidia. Fintechzoom tracks these factors to provide updated AMD stock predictions.

How does AMD’s sustainability focus affect its stock?

AMD’s commitment to sustainability and strong ESG (Environmental, Social, and Governance) practices make it appealing to eco-conscious investors. Fintechzoom highlights AMD’s ESG initiatives, which can have a positive impact on its stock’s long-term appeal.

Is AMD Stock Fintechzoom long-term investment?

Many experts see AMD as a good long-term investment due to its innovative product lineup and growth in high-demand sectors like AI and cloud computing. However, investors should weigh this potential against the risks of market volatility, which Fintechzoom regularly updates in its AMD stock predictions.

Conclusion

AMD’s stock remains a focal point in the semiconductor industry, driven by innovation, market dynamics, and global economic conditions. Through platforms like Fintechzoom, investors can access real-time updates and predictions, allowing them to stay informed on factors influencing AMD’s stock price.

With its strong competitive position, innovative products, and dedication to sustainability, AMD offers a blend of opportunity and risk that appeals to a wide range of investors. By considering expert insights and keeping abreast of the latest updates, investors can make informed decisions about their investment in AMD stock.