In a rapidly evolving digital landscape, Fintechzoom Meta Stock has captured the attention of investors looking to gain from one of the most influential technology giants in 2025. With constant innovation and strategic moves, Meta formerly Facebook has positioned itself as a pivotal player not only in social media but also in the metaverse and virtual reality sectors.

As we delve into Meta’s stock performance, it’s crucial to understand the dynamics shaping its valuation and investor interest this year.

This comprehensive update provides comprehensive insights, covering everything from key financial indicators to investor sentiment, allowing readers to make informed decisions in an increasingly competitive tech market.

Understanding Meta Stock Market Landscape

The 2025 market landscape has been particularly favorable for tech stocks, with Meta standing out due to its robust positioning and innovative pursuits. After rebranding and doubling down on its metaverse ambitions, Meta’s market position has strengthened considerably, leveraging new streams of revenue and increased user engagement across its platforms.

Meta’s ventures into AI-driven social media enhancements, the metaverse, and augmented reality devices have broadened its market influence. Investors keen on Fintechzoom Facebook Stock performance recognize its resilience and adaptability to changing digital trends, which are essential in sustaining its growth trajectory.

Additionally, Meta’s recent acquisitions and partnerships have further solidified its competitive edge. With Meta trends 2025 indicating a continued push in both AR and VR fields, it’s clear that Meta is set on a transformative path to reshape digital interaction.

Live Fintechzoom Meta Stock Analysis

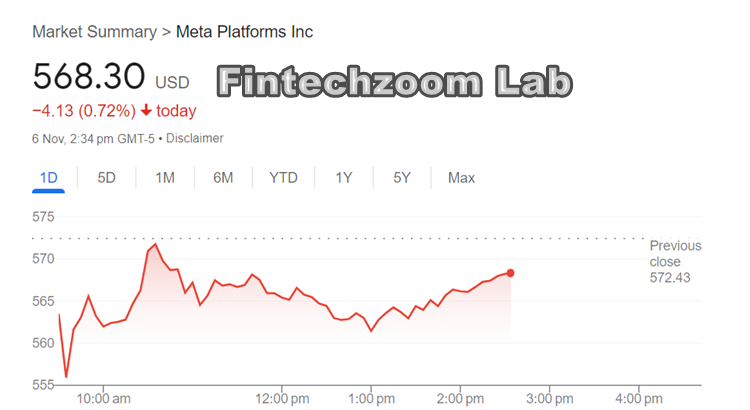

As of November, Meta Platforms Inc. (META) is trading at $566.50 per share, reflecting a slight decrease of 0.01% from the previous close. The day’s trading saw a high of $572.96 and a low of $555.42.

In its recent third-quarter earnings report, Meta reported earnings per share of $6.03 and revenue of $40.6 billion, surpassing analysts’ expectations. However, the company anticipates increased infrastructure expenses in the coming year, which has raised concerns among investors.

Analysts have varied perspectives on Fintechzoom Meta Stock. While some maintain a bullish outlook due to the company’s strategic investments in artificial intelligence and the metaverse, others advise caution, citing potential risks such as regulatory challenges and the substantial costs associated with new ventures.

For investors, it’s essential to monitor Meta’s ongoing financial performance, strategic initiatives, and broader market trends to make informed decisions regarding its stock.

Financial Indicators for Fintechzoom Meta Stock

Investors often rely on key financial indicators to gauge a stock’s potential. For Meta stock, metrics like earnings per share (EPS), revenue growth, and price-to-earnings (P/E) ratios provide a snapshot of its financial health and growth potential. Meta’s revenue growth in 2025 has demonstrated consistent gains, reflecting its ability to capitalize on its vast user base and diverse portfolio of products.

One notable financial metric is Meta’s P/E ratio, which allows investors to assess the stock’s value relative to its earnings. Meta’s stock EPS has seen steady improvement, indicating effective cost management and revenue generation.

With a rising P/E ratio, Meta is viewed as a promising long-term investment, though it’s essential to consider how it compares with other tech stocks. Meta revenue growth remains a strong indicator of its future potential, especially as it continues to invest heavily in the metaverse.

Major Catalysts Impacting Meta Stock in 2025

Several catalysts are influencing Meta’s stock movements this year. From advancements in virtual reality to artificial intelligence (AI) innovations, Meta’s developments are keeping investors optimistic. The launch of new VR headsets and enhanced AI-driven social media features have amplified Meta innovation 2025 and bolstered its market presence.

Externally, Fintechzoom Meta Stock catalysts include shifting regulatory landscapes and emerging digital market trends. For instance, increasing demand for virtual experiences has propelled Meta’s growth, with user engagement on platforms like Instagram and Facebook hitting new peaks.

Furthermore, Meta’s data privacy initiatives have earned it favorable public opinion, a critical aspect for sustaining user loyalty and market value. Meta stock predictions show optimism, given these strategic moves, although challenges remain.

Comparing Meta’s Performance with Tech Giants

In the competitive world of technology stocks, Meta holds a unique position due to its focus on the metaverse. When compared to other tech giants like Apple and Microsoft, Meta’s growth potential appears promising yet distinct. While Apple concentrates on hardware and Microsoft focuses on cloud computing, Meta has fully embraced virtual and augmented realities, pushing the boundaries of user interaction.

The comparison of Meta vs. tech giants becomes clearer in this regard, as Meta’s tech sector positioning is more niche yet forward-thinking. For investors, this distinction is crucial. Unlike traditional technology companies, Meta has doubled down on interactive digital spaces, which some analysts believe is an area set for exponential growth.

However, while Meta in the tech sector is exciting, its success will depend on market acceptance of the metaverse concept, making it riskier compared to more established segments like cloud services.

Investor Sentiment and Market Trends

Investor sentiment toward Meta stock remains cautiously optimistic. With the company’s recent performance and future-oriented strategies, there’s a palpable sense of anticipation for where Meta stock projections might lead. The metaverse and VR developments align with current market trends, particularly as businesses and individuals become more invested in immersive online experiences.

Investor sentiment Fintechzoom Meta Stock has shown a positive trajectory as Meta reports increasing user engagement across platforms. Still, some investors exercise caution due to the inherent risks of the tech industry.

With competitors rapidly innovating, the pressure is on Meta to stay ahead. Nevertheless, Meta’s strategic alignment with digital transformation has enabled it to resonate well with investors looking for growth stocks.

Risk Factors for Fintechzoom Meta Stock in 2025

Despite the positive outlook, Fintechzoom Meta Stock risks are worth considering. As a company operating on a global scale, Meta is subject to various regulatory requirements that can impact its financial performance. Regulatory concerns have been on the rise, especially as governments worldwide scrutinize tech giants for their market influence and data handling practices. These Meta regulatory concerns are critical, as non-compliance or unfavorable rulings could lead to significant financial repercussions.

Economic factors also play a role, with inflation and economic downturns potentially impacting advertising revenue a major income source for Meta. Furthermore, the AR and VR investments Meta is betting on may not yield the expected returns if user adoption falls short. Hence, Meta economic factors are important for investors who wish to mitigate risk.

Long-Term Outlook for Fintechzoom Meta Stock

As we look beyond 2025, Meta’s long-term outlook appears robust but not without challenges. Meta’s commitment to developing the metaverse and expanding its reach in augmented and virtual reality implies a strong strategic vision. For long-term investors, this dedication to cutting-edge technologies could be advantageous, especially as digital interaction continues to evolve.

However, achieving sustained growth will require Meta to maintain its competitive edge. The long-term Meta stock growth depends on its ability to innovate and capture market share in an industry that values rapid progression. For investors, this Fintechzoom Meta Stock 2025 forecast indicates both potential rewards and risks, underscoring the need for ongoing market assessment.

FAQs About Meta stock

What are the main factors influencing Meta’s stock performance in 2025?

Meta’s stock performance in 2025 is impacted by its ventures into the metaverse, advancements in VR and AR technologies, and shifts in digital advertising revenue.

Is Meta stock a good investment for the long term?

Meta stock is considered promising for long-term growth due to its focus on innovative technologies. However, investors should weigh the potential risks, such as regulatory challenges and economic factors.

How does Meta’s stock compare to other tech giants in 2025?

Compared to other technology companies like Apple and Microsoft, Meta’s stock focuses on digital experiences and metaverse development, distinguishing its position in the tech sector.

What are the biggest risks associated with investing in Meta stock?

Key risks include regulatory scrutiny, market acceptance of the metaverse, and the potential volatility in advertising revenue due to economic conditions.

What are Meta’s growth prospects in the metaverse industry?

Meta has made significant investments in the metaverse, aiming to lead in VR and AR experiences. While its prospects are strong, the success of these ventures depends on widespread adoption and technological advancements.

Conclusion

In conclusion, Fintechzoom Meta stock represents a unique investment opportunity in 2025. With its sights set on revolutionizing digital interaction through the metaverse and virtual reality, Meta has positioned itself as a forward-thinking tech company. While risks exist, particularly in the form of regulatory challenges and uncertain adoption of its VR/AR innovations, the potential for growth is significant.

For those interested in Meta’s stock performance, staying informed on market trends, financial indicators, and investor sentiment is key. With thoughtful assessment and an eye on both risks and rewards, investors can navigate the evolving landscape with confidence.