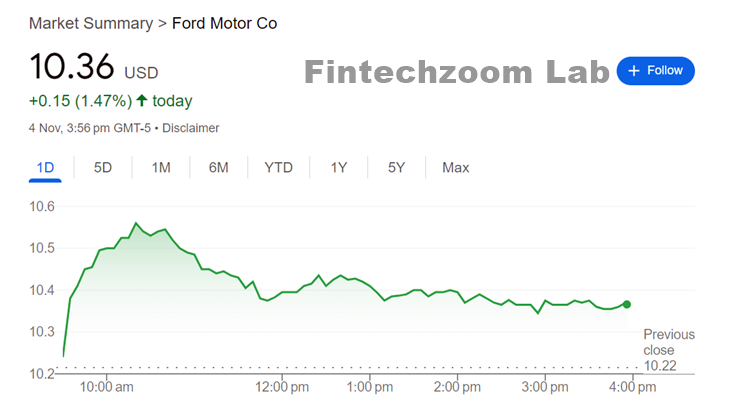

In an era where the automotive landscape is rapidly evolving, Ford Motor Company (NYSE: F) stands at a pivotal crossroads, balancing its storied legacy with ambitious electric vehicle (EV) initiatives. With Fintechzoom Ford Stock prices currently hovering around $10.22 and significant fluctuations in recent months, investors are keenly analyzing Ford’s performance amidst rising production costs and intense competition from EV frontrunners like Tesla.

This comprehensive analysis from FintechZoom Lab delves into the factors influencing Fintechzoom Ford Stock, from macroeconomic challenges to strategic shifts in its product lineup, providing valuable insights for both prospective investors and market enthusiasts alike.

Understanding Ford’s Market Position

To make informed investment choices, understanding Ford’s position within the automotive landscape is essential. With more than a century of history, Ford has long been a cornerstone of the American automotive industry. Despite its long-standing reputation, the company faces fierce competition from Tesla, Rivian, and legacy rivals like General Motors (GM).

Ford’s strategic shift toward electrification, marked by the successful launch of models like the Ford Mustang Mach-E and the Ford F-150 Lightning, reflects its commitment to staying relevant. These innovations signify that Ford isn’t content to rest on its laurels; it aims to capture a substantial share of the rapidly expanding electric vehicle (EV) market.

Current Ford Performance and Stock Analysis

Fintechzoom Ford Stock (NYSE: F) has recently been under pressure, trading around $10.29, which is close to its 52-week low of $10.13. This decline reflects broader concerns regarding the company’s profitability, especially in its electric vehicle (EV) segment, where significant investments have yet to yield the anticipated returns.

Analysts are wary about Ford’s ability to compete effectively in a rapidly evolving EV market, particularly against established competitors like Tesla market and emerging players that are also vying for market share. The stock’s downward trajectory is partly attributed to these competitive pressures and the need for Ford to adapt its business model to ensure sustainable growth.

Additionally, Fd has recently lowered its full-year guidance, signaling challenges in meeting financial targets. This adjustment has led to skepticism among investors, particularly as operational costs rise amid a complex supply chain landscape. Despite the hurdles, Ford continues to emphasize its commitment to EV production, aiming to boost its output and enhance vehicle margins over time.

Current Market Trends Impacting Ford

One of the most critical factors influencing Fintechzoom Ford Stock is the current trend toward sustainability and green energy. Governments worldwide have been pushing for stricter emissions regulations and incentives for EV adoption. This has led Ford to enhance its research and development investments in electric and hybrid vehicles.

The company’s recent strategic focus on electrification aims to solidify its position against dominant players like Tesla. The development of the Ford F-150 Lightning, an electric version of its bestselling truck, is a testament to this strategy. If successful, such models can provide a substantial boost to Ford’s stock price.

FintechZoom’s market insights indicate that while the shift to electrification is promising, it also carries inherent risks. The costs of transitioning to new technologies, potential delays in production, and fluctuating consumer demand can all impact profitability.

Factors Influencing Fintechzoom Ford Stock

Several external economic factors also play a role in the performance of Fintechzoom Ford Stock. For instance, inflation rates, interest rate hikes, and global supply chain disruptions are pivotal. The economic slowdown during the pandemic demonstrated how vulnerable the automotive sector can be to global crises.

Recently, Ford has navigated these economic headwinds by optimizing its operations and cutting costs. The company’s strategic partnerships, such as its collaborations with tech companies for autonomous driving solutions, also indicate a forward-thinking approach that could pay off in the long run.

Financial Metrics: A Deeper Dive

For a more in-depth investment analysis, one must delve into Ford’s financials. Key metrics such as earnings per share (EPS), revenue growth, and profit margins offer insights into the company’s health.

FintechZoom’s financial review notes that Ford’s EPS has seen fluctuations due to various factors, including the aforementioned global chip shortage and the expenses related to its push for electrification. However, analysts have noted that Ford’s balance sheet remains strong, with sufficient liquidity to manage its debts and invest in future technologies.

Revenue trends show a mixture of growth and stagnation, primarily influenced by production capabilities and global economic conditions. The recent rise in demand for electric vehicles has the potential to create positive revenue spikes, assuming Ford can manage production efficiently.

Investor Sentiment and Market Forecasts

Understanding investor sentiment is crucial for those considering Fintechzoom Ford Stock. Market analysts and reports from platforms like FintechZoom provide valuable insights into how other investors view the stock’s potential.

Some investors are bullish on Ford, driven by confidence in its pivot toward electric and autonomous vehicles. These investors see the company’s proactive steps in sustainability and innovation as signs of long-term growth potential. FintechZoom’s Ford stock analysis reflects that while there is optimism, the sentiment is tempered by caution due to potential economic and competitive challenges.

The company’s stock price forecasts vary, with some analysts predicting a steady upward trend as new electric models hit the market and others advising a wait-and-see approach due to the risks associated with technological transitions and global economic uncertainties.

Comparative Analysis with Competitors

A comprehensive investment analysis would be incomplete without a comparison to Ford’s main competitors. Fintechzoom Ford Stock performance should be evaluated in the context of industry leaders such as Tesla, GM, and Toyota.

Tesla’s dominance in the EV market sets a high benchmark for traditional automakers. However, Ford’s competitive edge lies in its established manufacturing capabilities and brand trust. Unlike newer entrants that face scaling challenges, Ford already has robust infrastructure in place. This gives Ford a potential cost advantage when scaling up electric vehicle production.

Fintechzoom Ford Stock insights indicate that while Tesla continues to dominate with its technology-first approach, Ford’s hybrid and electric models cater to consumers seeking a blend of tradition and innovation. General Motors, on the other hand, has also made strides in the EV sector, competing closely with Ford through initiatives like its Ultium battery platform.

Technological Advancements and Ford’s R&D Investments

Ford’s investment in research and development (R&D) has been pivotal for its future growth. The company has been focusing on technologies such as self-driving capabilities, advanced safety features, and battery efficiency. Collaborations with tech companies and strategic acquisitions have also bolstered Ford’s technological prowess.

FintechZoom’s reports on Ford’s tech strategy highlight that these investments are essential for maintaining competitive advantages. However, the success of these initiatives will depend on Ford’s ability to scale them effectively and integrate new technologies without significant disruptions.

Potential Risks and Considerations

Every investment comes with its set of risks. For Fintechzoom Ford Stock, the risks are multifaceted and range from global economic conditions to company-specific challenges. Potential investors should consider:

- Supply chain vulnerabilities: Continued issues with the global supply chain can impact Ford’s production capabilities, affecting its revenue and stock price.

- Technological adoption: While Ford is investing in electric and autonomous vehicle technology, the speed of adoption by consumers remains uncertain.

- Competitive pressure: New and existing competitors continue to push forward with innovations that could overshadow Ford’s advancements.

- Macroeconomic factors: Inflation, interest rate changes, and geopolitical issues can also influence Ford stock and the broader automotive sector.

Role of FintechZoom in Investor Decisions

Platforms like FintechZoom offer invaluable data and insights for potential investors. By providing comprehensive Ford stock analysis, market forecasts, and expert opinions, FintechZoom Pro helps investors stay informed about current trends and future projections.

The platform’s ability to synthesize large amounts of data into actionable insights allows investors to understand complex stock behaviors and make educated decisions. For those eyeing Fintechzoom Ford Stock, leveraging FintechZoom’s analytics can be a strategic advantage.

Conclusion

After considering Fintechzoom Ford Stock analysis, current market trends, and competitive landscape, the question remains: Is now the right time to invest in Ford stock? The answer ultimately depends on an individual’s investment strategy and risk tolerance.

For those who are confident in Ford’s long-term strategy and believe in the potential of its EV and technological initiatives, investing now could be a calculated risk with possible high returns. However, investors who are wary of the current market volatility and the competitive pressures might prefer to observe how Ford’s upcoming projects unfold before making a commitment.

Using resources like FintechZoom to stay informed ensures that potential investors are not only aware of Ford’s current position but are also prepared for any shifts in the market. Whether one chooses to invest immediately or wait, understanding the comprehensive analysis and key metrics is essential for making the best financial decision.

FAQs About Ford Stock

What are the main factors influencing Ford’s current stock performance?

Ford’s stock performance is influenced by various factors, including global economic conditions, supply chain disruptions, competition from EV manufacturers, and consumer demand for both traditional and electric vehicles.

How does Ford’s electric vehicle strategy impact its stock value?

Ford’s shift toward electric vehicles (EVs), highlighted by models like the F-150 Lightning, plays a significant role in its stock value. Success in the EV market could boost investor confidence and stock price, but challenges like production delays can create volatility.

Is Ford stock a good long-term investment?

The answer depends on Ford’s ability to adapt to changing market trends, maintain steady revenue, and handle competitive pressures. Long-term investors might find value if they believe in Ford’s strategic EV initiatives and its financial stability.

What are the risks associated with investing in Ford stock?

Investing in Ford stock comes with risks such as economic downturns, rising production costs, evolving regulations, and competition from newer EV companies like Tesla and Rivian.

How does Ford compare to other major automakers in terms of stock performance?

Compared to Tesla, General Motors, and Toyota, Ford’s stock has shown resilience but also lags behind in terms of aggressive EV market capture. Investors often look at these comparisons to gauge Ford’s competitive position.